These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. However, the more prevalent treatment in practice has been for all outstanding options – regardless of if they are in or out of the money – to be included in the calculation. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

Protecting Company Autonomy: A Shield Against Takeovers

- Treasury stocks that are retired or canceled are also known as terminated stocks or canceled stocks.

- Companies that do direct repurchases buy shares on the secondary market, just like regular investors do.

- Following the repurchase, the formerly outstanding shares are no longer available to be traded in the markets and the number of shares outstanding decreases – i.e. the reduced number of shares publicly traded is referred to as a decline in the “float”.

- Retired shares have the potential to decrease the number of outstanding shares, which in turn can help minimize dilution.

- They claimed that the cancellation of 1 billion shares served as a symbolic gesture, commemorating the company’s successful completion of a groundbreaking project.

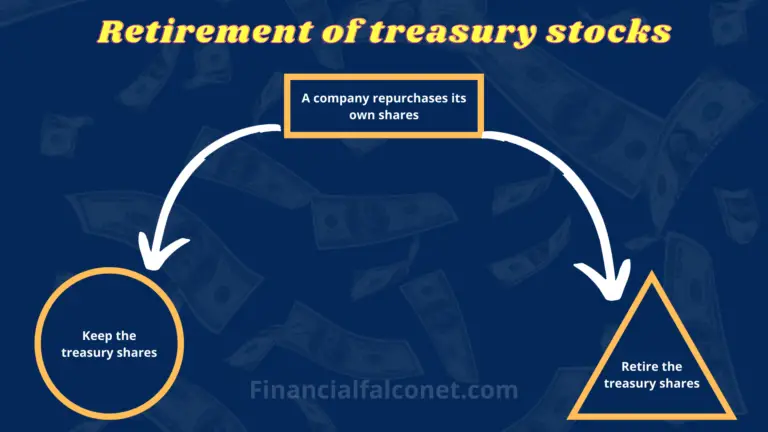

Occasionally, a corporation may repurchase its stock with the intention of retiring it rather than holding it in the treasury. Overall, this is a strategy companies use to manage their capital structure, signal confidence in their stock, and potentially enhance shareholder value. Retired shares have the potential to decrease the number of outstanding shares, which in turn can help minimize dilution. The United Kingdom equivalent of treasury stock as used in the United States is treasury share.

Submit to get your retirement-readiness report.

Treasury Stock is credited for the total cost of the shares sold, and the account Additional Paid-in Capital from the Sale of Treasury Stock Above Cost is credited for the difference. Finally, no treasury stock held by the corporation taxable income on your 2021 irs tax return due in 2022 has any dividend or voting rights. Third, the fiduciary responsibilities of the board require it to protect the interests of all creditors and stockholders such that an excessive amount of funds should not be spent to obtain shares.

Treasury Stock in Diluted Share Count Calculation

Treasury stock is considered a contra-equity account, meaning it reduces the overall equity value. For instance, when a company repurchases shares, the cost of those shares is debited from the treasury stock account, and the cash account is credited for the amount paid. The retirement of treasury stock involves the buyback of a company’s own shares and then permanently canceling them to make them unavailable on the open market. Treasury stocks that are retired or canceled are also known as terminated stocks or canceled stocks.

Get in Touch With a Financial Advisor

Corporations issue stock for a variety of reasons, including the need to raise money for operating capital and to expand operations or pay off debt. How the company accounts for those shares determines whether this stock is treasury stock or retired stock. It also aids in promoting the enhancement of a firm’s financial metrics enhancement and also to consolidate ownership.

An alternative method of accounting for treasury stock is the constructive retirement method, which is used under the assumption that repurchased stock will not be reissued in the future. Under this approach, you are essentially reversing the amount of the original price at which the stock was sold. The remainder of the purchase price is debited to the retained earnings account. The price paid in excess of the amount accounted for as the cost of the treasury shares shall be attributed to the other elements of the transaction and accounted for according to their substance.

This arrangement tends to reduce the investor’s risk of a decreased market value. Look for the company name and location of incorporation, a CUSIP number, and the name of the person with whom the security is registered. All of these items are important and can likely be found on the certificate’s face. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. In effect, the balance of the Treasury Stock contra account is closed into the balance of the Common Stock account.

The number available only to the public to buy and sell is known as the float. In comparison, non-retired treasury stock is held by the company for the time being, with the optionality to be re-issued at a later date if deemed appropriate. That said, treasury stock is shown as a negative value on the balance sheet and additional repurchases cause the figure to decrease further. If the equity ownership of a company is more concentrated, takeover attempts become far more challenging (i.e. certain shareholders hold more voting power), so share buybacks can also be utilized as a defensive tactic by management and existing investors. In this case, the cost of buying back the treasury stock is $100,000 less than the amount the company ABC received which was $300,000 ($100,000 x $3 per share) when it issued the stock. For example, on August 31, the company ABC decides to buy back 100,000 shares of its common stock for $500,000.

Later, on September 30, the company ABC decides to retire these 100,000 shares in order to increase the value of stock in the company. Corporations use buybacks to reduce the amount of shares in circulation, thereby boosting their stock price. In 2023, the top 500 companies spent nearly $800 billion to repurchase their own shares. A treasury paid-in capital account is also either debited or credited depending on whether the stock was resold at a loss or a gain. Apple Inc. (AAPL) is a company that aggressively bought back its own shares from 2012 to 2020. Every quarter over that time frame, AAPL bought roughly $10 billion worth of its own stock.