For example, assume an investor owns 200 shares with a market value of $10 each for a total market value of $2,000. Instead, the company prepares a memo entry in its journal that indicates the nature of the stock split and indicates the new par value. The balance sheet will reflect the new par value and the new number of shares authorized, issued, and outstanding after the stock split.

Journal Entry Sequences for Stock Dividends

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Great! The Financial Professional Will Get Back To You Soon.

- The total stockholders’ equity on the company’s balance sheet before and after the split remain the same.

- The company pays out dividends based on the number of stock shares it has outstanding and will announce its dividend as a certain amount per share, such as $1.25 per share.

- The date of payment is the date that payment is issued to the investor for the amount of the dividend declared.

- This is referred to as capitalizing retained earnings and makes that part of retained earnings transferred to permanent capital unavailable for future cash dividends.

The frequency and amount of dividends paid are determined by the company and normally follow regular patterns, such as quarterly or annually. For example, assume that an individual owns 1,000 shares of South Gulf Oil Company. If you don’t need to report in GAAP, you probably have a simpler business structure and fewer shareholders.

Journal Entries for Withholding Tax

As such, although the number of outstanding shares and the price change, the total market value remains constant. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. The total value of the candy does not increase just because there are more pieces. A traditional stock split occurs leveraged loan funds when a company’s board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder.

The carrying value of the account is set equal to the total dividend amount declared to shareholders. Once a proposed cash dividend is approved and declared by the board of directors, a corporation can distribute dividends to its shareholders. A high dividend payout ratio is good for short term investors as it implies a high proportion of the profit of the business is paid out to equity holders. However, a high dividend payout ratio leads to low re-investment of profits in the business which could result in low capital growth for both the business and investor. A long term investor might be prepared to accept a lower dividend payout ratio in return for higher re-investment of profits and higher capital growth. Receiving the dividend from the company is one of the ways that shareholders can earn a return on their investment.

Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. As the company has declared a 10% stock dividend, it would be accounted just like a cash dividend. Stock dividends (also called bonus shares) refer to issuance of shares of common stock by a company to its existing shareholders in the proportion of their shareholding without any receipt of cash. To demonstrate the journal entries required when a cash dividend is declared and paid, let’s return to the above example.

In some states, corporations can declare preferred stock dividends only if they have retained earnings (income that has been retained in the business) at least equal to the dividend declared. When investors buy shares of stock in a company, they effectively become part-owners of the firm. In return, the company may choose to distribute some of its earnings to these owners, or shareholders, in the form of dividends.

Stock investors are typically driven by two factors—a desire to earn income in the form of dividends and a desire to benefit from the growth in the value of their investment. Members of a corporation’s board of directors understand the need to provide investors with a periodic return, and as a result, often declare dividends up to four times per year. However, companies can declare dividends whenever they want and are not limited in the number of annual declarations. They are not considered expenses, and they are not reported on the income statement. They are a distribution of the net income of a company and are not a cost of business operations. Such dividends—in full or in part—must be declared by the board of directors before paid.

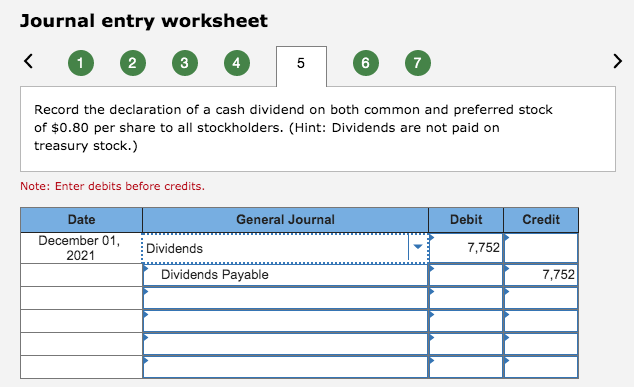

The shareholders who own the stock on the record date will receive the dividend. Although, the duration between dividend declared and paid is usually not long, it is still important to make the two separate journal entries. To record the payment of a dividend, you would need to debit the Dividends Payable account and credit the Cash account. When the dividend is paid, the company’s obligation is extinguished, and the Cash account is decreased by the amount of the dividend.

Whether you follow GAAP or use cash-basis accounting, you can make sure your financial reports are accurate with proper dividend reporting. The Dividends Payable account records the amount your company owes to its shareholders. In the general ledger hierarchy, it usually nestles under current liabilities. The Board’s declaration includes the date a shareholder must own stock to qualify for the payment along with the date the payments will be issued.

A Southern California native, Cynthia received her Bachelor of Science degree in finance and business economics from USC. On the Date of Payment, you would make an entry to debit Stock Dividends Distributable and credit the Common Stock account. Depending on your individual circumstances, dividends received may be subject to taxation. It is important to consult with a qualified tax professional for more information about how dividends will affect your personal taxes.