Fixed-price mortgages bring predictability, if you find yourself changeable-speed fund give you the potential for all the way down costs. Understanding how this type of loan brands affect can cost you can help you dictate and this suits your own quick and you can long-title requires top.

By Christopher Boston Examined from the Timothy Manni Modified by Casie McCoskey Of the Christopher Boston Analyzed by Timothy Manni Modified of the Casie McCoskey In this post:

- Variable-Speed Mortgages

- A part-By-Top Research

- Secret Considerations

Opting for a house try fun, before you could potentially unpack those moving packages, there is certainly a significant choice you should generate: If you do a fixed-speed otherwise a changeable-price home loan?

Why don’t we step back. A home loan is actually financing that can help you purchase a home. The word rate is the desire you only pay towards loan. When it comes to going for anywhere between a predetermined-speed and you will a varying-rates, the real difference is based on whether this interest rate remains constant or can change throughout the years. Insights this type of subtleties could save you currency and ensure that home loan aligns along with your economic comfort zone. Remember, the decision make a difference to your financial condition for many years.

What is a fixed-Price Home loan?

A predetermined-price home loan is actually a home loan in which your own interest will not change over date. Instance, you could potentially lock in a speeds off 3.5% on your mortgage. That means you will end up paying step 3.5% interest on your financing for the whole period of the term, should it be 15, 20 or three decades.

Sort of Fixed-Rate Mortgages

When looking at the choices, its helpful to see the different types of repaired-rate mortgage loans readily available. Once you understand these could make suggestions on the one that fits your financial condition and you may long-label needs.

- 15-Season Repaired Speed: This package allows you to pay-off your property within the 15 years. This new monthly premiums is large, however you will spend less interest along side longevity of the loan.

- 30-Year Fixed Price: Which have straight down monthly obligations spread out over a longer name, this is certainly a popular option for people who prefer quicker, so much more down payments.

- Compliant Fixed Rates: This is exactly a loan you to definitely uses this new limits set by the regulators-paid organizations (getting 2024, the fresh restrict is actually $766,550). Its a good idea in loan places Loachapoka case the amount borrowed drops on these limits.

- Non-compliant Fixed Rate: Labeled as good jumbo loan, this might be to possess lenders one surpass new compliant constraints.

Knowing the different varieties of fixed-speed mortgages can make a big difference in your home to find journey. Per choice boasts unique have one to focus on certain economic means and you can desires. You could potentially find a loan design you to best suits your position, and come up with your own path to help you homeownership much easier plus individualized.

- Navigating the new Foreclosure Processes: The Actionable Help guide to Financial Resilience

- Homeownership Software and Support if you have Disabilities

- Crunching Wide variety: How to Calculate this new Collateral of your home Particularly an expert

Positives and negatives of a fixed-Price Mortgage

Let us explore the huge benefits and prospective cons regarding fixed-rate mortgages. This informative article can assist you understand whenever a predetermined-price mortgage is going to be of good use and if it might expose challenges.

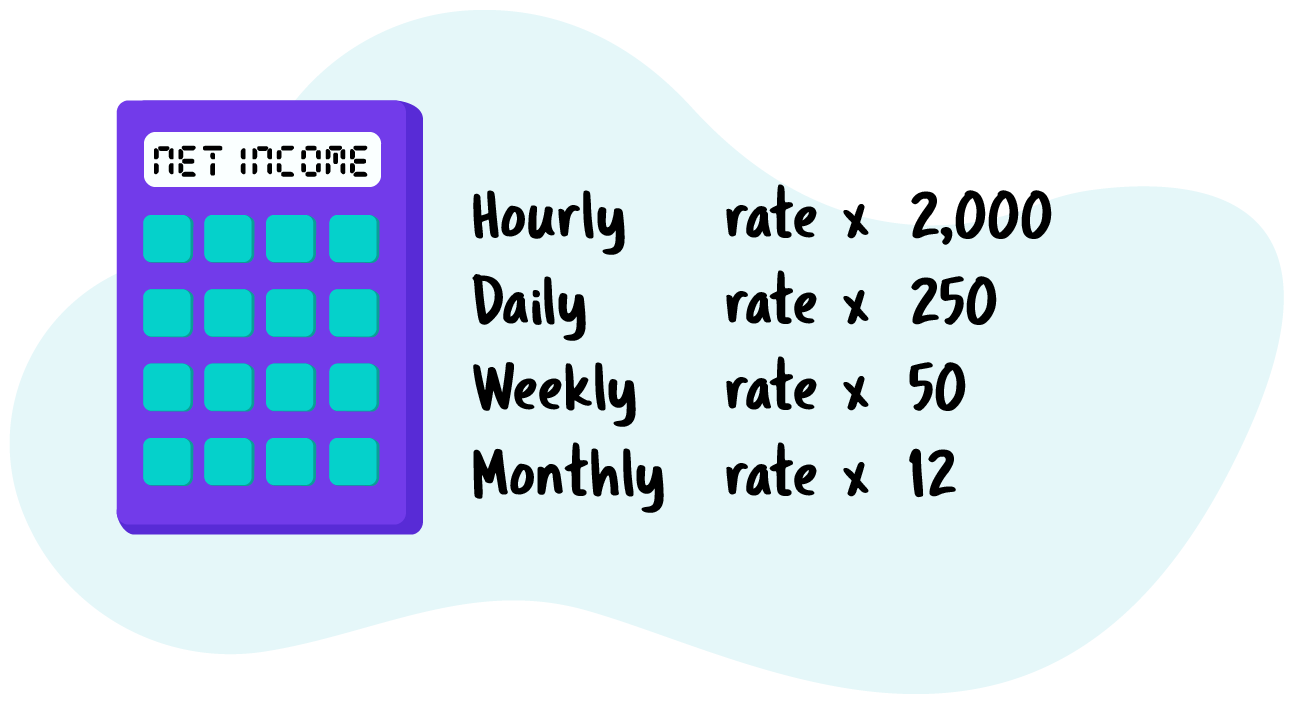

Sure, you could potentially estimate your monthly mortgage payment manually, however, why do if you can have an excellent calculator would they for your requirements? MoneyGeek’s mortgage calculator will give you a projected payment per month within minutes. All you need to carry out is promote the loan matter, financing term and you will interest rate. It’s a fuss-100 % free cure for understand how these different facets make a difference the finances, working for you build an educated decision regarding the home loan.

What’s a varying-Rates Mortgage?

An adjustable-price mortgage, known as an adjustable-rate home loan (ARM), is a type of home loan where your own rate of interest is also change-over time. Can you imagine the mortgage begins with mortgage loan from dos.5%. Shortly after a specific several months, one rate may improve otherwise disappear predicated on alterations in a great site rate of interest, eg SOFR or even the You.S. Prime Rate.