The NPV values are graphed on the vertical or y-axis while the discount rates are graphed on the horizontal or x-axis. In summary, while the NPV profile is a valuable tool, it’s essential to recognize its limitations. Combining it with other evaluation methods and considering qualitative aspects ensures a more holistic decision-making process. Remember that no financial model can perfectly predict the future, but thoughtful consideration of these limitations can enhance our understanding of investment projects. Net Present Value is a critical tool in financial decision-making, as it enables investors and financial managers to evaluate the profitability and viability of potential investments or projects.

Basics of Net Present Value Calculation

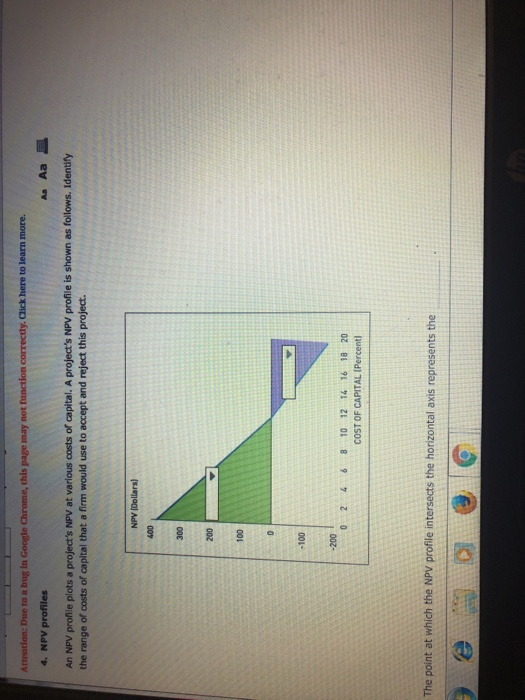

If you are confident that the firm’s cost of attracting funds is less than 14%, the company should accept the project. If the cost of capital is more than 14%, however, the NPV is negative, and the company should reject the project. Theoretically, we should use the firm’s cost to attract capital as the discount rate when calculating NPV.

Net Present Value vs. Internal Rate of Return

Thus, JKL Media, given its projected cash flows, has a project with a 17.15% return. If there were a project that JKL could undertake with a higher IRR, it would probably pursue the higher-yielding project instead. Both of these measurements are primarily used in capital budgeting, the process by which companies determine whether a new investment or expansion opportunity is worthwhile. Given an investment opportunity, a firm needs to decide whether undertaking the investment will generate net economic profits or losses for the company.

Step 1: NPV of the Initial Investment

When the interest rate increases, the discount rate used in the NPV calculation also increases. This higher discount rate reduces the present value of future cash inflows, leading to a lower NPV. As a result, projects or investments become less attractive because their potential profitability appears diminished when evaluated against a higher required rate of return. No matter how the discount rate is determined, a negative NPV shows that the expected rate of return will fall short of it, meaning that the project will not create value. A net present value profile indicates the project’s financial attractiveness relative to the discount rate.

Multiple IRRs, however, cannot occur in conventional projects which have outlay followed by cash inflows. Nevertheless, they may occur in non-conventional projects which have cash flows whose signs change (negative, positive) more than once during the the life of a project. The your taxable income is a graphical illustration of a project’s NPV graphed as a function of various discount rates.

- Theoretically, we should use the firm’s cost to attract capital as the discount rate when calculating NPV.

- In general, projects with a positive NPV are worth undertaking, while those with a negative NPV are not.

- This is because a higher discount rate reflects a higher opportunity cost of investing in the project, while a lower discount rate reflects a lower opportunity cost.

- NPV is sensitive to changes in the discount rate, which can significantly impact the results.

Remember, npv sensitivity analysis isn’t about predicting the future with certainty; it’s about understanding the range of possible outcomes. By considering these key variables, you’ll be better equipped to make strategic investment decisions. If the NPV profile remains below the x-axis for all discount rates, it suggests that the project is not expected to generate positive net present values at any discount rate. This indicates that the project may not be economically feasible and should be avoided. The point where the NPV curve crosses the x-axis signifies the internal rate of return (IRR). In summary, the NPV profile graph provides a visual roadmap for decision-makers.

While NPV offers numerous benefits, it is essential to recognize its limitations, such as its dependence on accurate cash flow projections and sensitivity to discount rate changes. A positive NPV indicates that the investment or project is expected to generate a net gain in value, making it an attractive opportunity. The higher the positive NPV, the more profitable the investment or project is likely to be. Using the discount rate, calculate the present value of each cash flow by dividing the cash flow by (1 + discount rate) raised to the power of the period in which the cash flow occurs. This calculation will provide the present value of each cash flow, adjusted for the time value of money.

NPV is widely used in capital budgeting to evaluate the profitability of potential investments in long-term assets, such as machinery, equipment, and real estate. For example, IRR could be used to compare the anticipated profitability of a three-year project with that of a 10-year project. However, what if an investor could choose to receive $100 today or $105 in one year?

However it’s determined, the discount rate is simply the baseline rate of return that a project must exceed to be worthwhile. From the perspective of investors, the NPV profile offers a clear picture of the project’s potential returns and risks. By plotting the npv against the discount rate, one can identify the rate at which the project becomes economically feasible. This information aids in determining the project’s attractiveness and its alignment with the investor’s financial goals. In this section, we will delve into the concept of Net Present Value (NPV) Profile and its significance in evaluating investment projects.

This conflict usually stems from differences in the cash flows of the two projects, which leads to a different ranking between the NPV and IRR. Whenever this conflict arises, the NPV, and not the IRR, should be used to select the project to invest in. Consider another project B, which requires an initial investment of $400 million and no cash flows in the next three years and $800 million in the last year. The discount rate used in NPV calculations is a critical factor in determining the result. A higher discount rate will result in a lower NPV, while a lower discount rate will result in a higher NPV.