As well as letting you tap into your property guarantee, this type of money issues promote some other gurus. Why don’t we examine a number of them.

HELOC professionals

HELOC funds leave you far more borrowing from the bank independence than simply house security loans. As you have an extended draw months, you can access just the amount of cash you would like, proper when it’s needed. Quite simply, that one can help you defend against borrowing from the bank too far.

The latest fees procedure getting a beneficial HELOC includes experts as well. Some think it’s more straightforward to budget for the smaller repayments within the attracting several months. During that time, you may also get ready for the greater costs which you yourself can build in installment months.

HELOCs might have all the way down interest rates than simply domestic collateral loans and unsecured borrowing from the bank options eg playing cards. Also, by using brand new HELOC’s cash on certified home renovations, the Irs can even allow you to deduct the eye repaid towards your taxation come back.

Domestic equity loan masters

If you’d like all your valuable money at a time, you can even choose the lump sum payment that a home equity mortgage brings therefore the predictability which comes from it. The best house security funds element repaired rates and you can secure payment numbers. The cost management becomes easier after you understand how far you have got to pay monthly.

Even if house guarantee fund have higher interest rates than just HELOCs, you can easily Cleveland installment loans bad credit generally nevertheless save money more possibilities such as for example credit cards. (When you find yourself suffering from large-notice credit debt currently, you are in a position to spend it down having fun with property guarantee mortgage). Likewise, the new repaired speed form you will not have to worry about rising rates of interest raising the price of the debt. The latest government income tax deduction getting attention paid pertains to house collateral fund also.

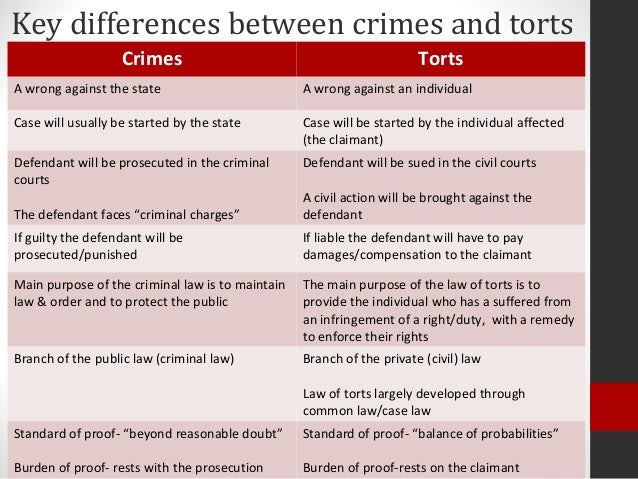

Since you find out more about home collateral, you are bound to see new words Household Guarantee Line off Credit, otherwise HELOC and you can Domestic Guarantee Loan. They are both options to use the security of your property in order to funds other expenses into your life. HELOCs and you will Household Collateral Funds setting in different ways and you may cater to more economic needs. Let’s glance at the key differences between HELOCs and property security loan.

HELOC: Definition & Advantages

A property Collateral Personal line of credit is exactly one to, a personal line of credit you take away, the same as a personal line of credit you have made regarding a credit credit. Same as credit cards, youre given a borrowing limit for how much your can use of your home’s collateral. You will find several things that place HELOC’s aside.

Flexibility: You can borrow funds, payback the money, and borrow again so long as you sit inside your approved credit limit. It now offers numerous independency along the drawing months, that is typically 5 so you can 10 years long.

Interest levels: HELCOs normally incorporate varying rates, and therefore brand new payment per month you create changes or fluctuate according to interest rate and industry requirements.

Straight down 1st Payments: During the attracting several months, you could make money toward precisely the attention, definition lower monthly obligations 1st. You are able to pay down their attention or concept on drawing period, definition you might enjoys down repayments during the installment several months.

Of numerous Spends: HELOCs can be used for some aim and will help you to get prior to personal debt because of the consolidating your loans towards the you to fee. It also helps you with house renovations, studies costs, and more.

House Collateral Financing

A home Equity Mortgage are really better-labeled as the next mortgage. Which mortgage also provides a lump sum of cash that’s lent up against a person’s domestic collateral. They operates more differently than just an effective HELOC and such as for instance financing or financial.