When evaluating a company, it’s important to consider other profitability measurements as well. Companies can also mislead investors by reporting “adjusted” EPS and removing certain expenses from the calculation. However, the diluted figure is generally better and more comprehensive when making investment decisions.

Table of Contents

If a company pays out $0.60 per share in dividends over the course of a year and has EPS of $0.40, it has a dividend payout ratio of 150% and will not be able to afford its dividend indefinitely. PE ratio is equal to a company’s share price divided by its EPS over the last 12 months. It’s a way of evaluating the price of a company in terms of its earnings.

What is your current financial priority?

- Earnings per share (EPS) is an important metric that investors and analysts use to assess the profit a company generates per share of stock.

- You can also compare EPS values for a few companies within the same industry to choose the most profitable one.

- So, if a company has securities that could increase the number of shares outstanding, diluted EPS will be lower than basic EPS.

- The earnings per share (EPS) reported by a company per GAAP accounting standards can be found near the bottom of a company’s income statement, right below net income.

Diluted EPS is calculated using a larger number of shares than basic EPS. Our partners cannot pay us to guarantee favorable reviews of their products or services. This means that if Quality distributed every dollar of income to its shareholders, each share would receive 10 dollars. This measurement typically includes figures from the four quarters of the current fiscal year, some of which may have already elapsed, and some of which are yet to come. As a result, some of the data will be based on actual figures and some will be based on projections. In fact, a trailing EPS is calculated using the previous four quarters of earnings.

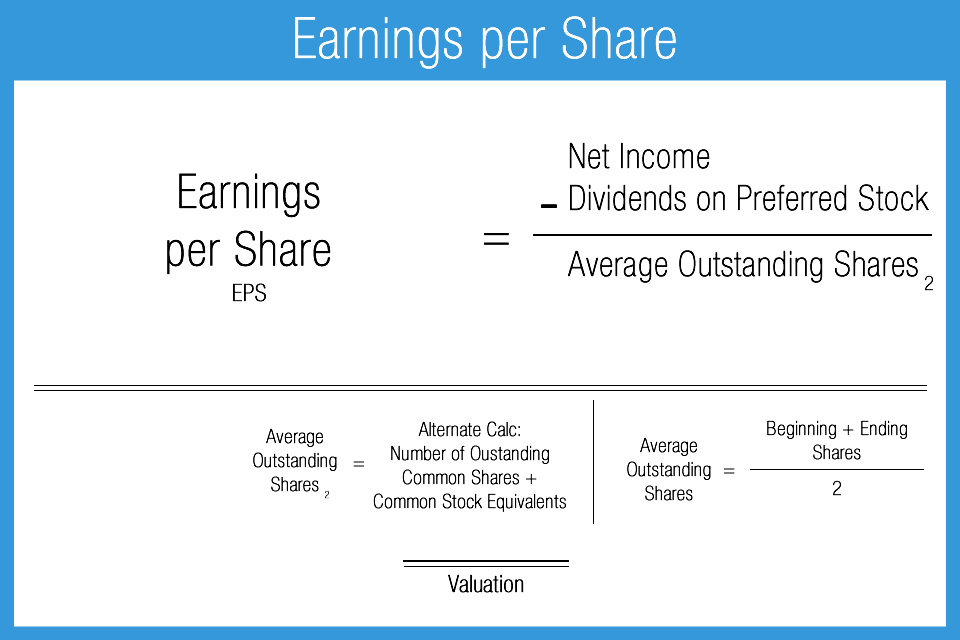

What do I need to calculate the Earnings per Share (EPS) ratio?

Using an average of outstanding shares can provide an accurate picture of the earnings for the company. Since we now have the beginning and ending number of common shares outstanding, the next step is to calculate the weighted average shares outstanding. If it loses $10 million with 10 million shares outstanding, basic loss per share is $1.00 even. But the outstanding options — whether in the money or not — do not affect diluted share count.

The calculation of diluted EPS takes into account the impact of convertible securities and employee stock options that could dilute the company’s earnings per share. So, if a company has securities that could increase the number of shares outstanding, diluted EPS will be lower than basic EPS. It is often reported on a basic and diluted basis, deluxe online customer ratings and product reviews which takes into account the impact of dilutive securities such as stock options and convertible debt. Earnings per Share is a critical financial metric, informing investors of a company’s profitability and influencing its stock value. Its calculation takes into account net income, outstanding shares, and dividends, among others.

Stay on top of changes and updates to financial reporting with help from our accounting thought leaders. Everybody from CEOs to research analysts is obsessed with this often-quoted number. For example, on May 31, 2023, online pet supply vendor Chewy reported EPS of $0.05 per share for Q1 2023, when the consensus estimate was -$0.04 per share.

What counts as a good EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. Sometimes, a company might report growing EPS, but the stock might decline in price if analysts were expecting an even higher number. An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation. A metric that can be used to identify more efficient companies is the return on equity (ROE). The shares that would be created by the convertible debt should be included in the denominator of the diluted EPS calculation, but if that happened, then the company wouldn’t have paid interest on the debt. In this case, the company or analyst will add the interest paid on convertible debt back into the numerator of the EPS calculation so the result isn’t distorted.

You can also compare EPS values for a few companies within the same industry to choose the most profitable one. But in actuality, stock splits and reverse splits can still affect a company’s share price, which depends on the market’s perception of the decision. Therefore, to summarize the net impact on the earnings per share (EPS) line item, new stock issuances cause a company’s EPS to decline, whereas stock buybacks result in an artificially higher EPS. Stock buybacks and new stock issuance are two methods for publicly-traded companies (post-IPO) to directly impact their number of outstanding shares.